Authored 02 Books on GST

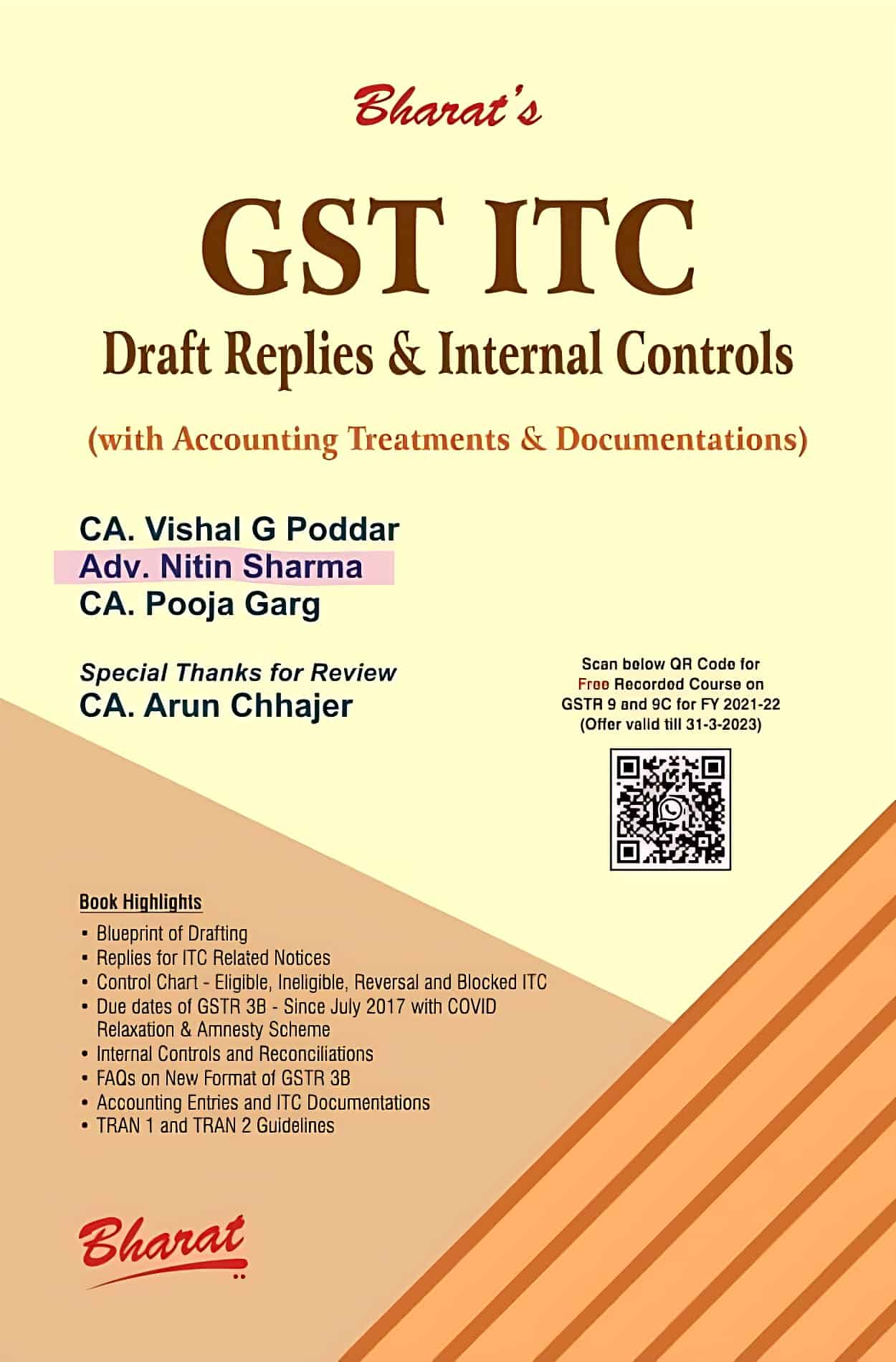

First Book on GST – “GST ITC- Draft Replies & Internal Controls“

GST ITC- Draft Replies & Internal Controls is a Book for Professionals, new comers, Trade and Industry facing ITC related issues and notices from GST Department regarding Input Tax Credit and eligibile Claims. Registered Person in GST may receive different notices related to availment and utilization of Input Tax Credit and this book has covered all aspects in relate to legitimate ITC.

Highlights of the Book

- Introduction

- Blueprint of Drafting

- ITC-related notices and draft replies

- Control Chart – Eligible/Ineligible with Reversal and Blocked ITC

- Due dates of GSTR 3B and Relaxation in late Fees and Interest during COVID

- Internal Control and Reconciliations

- FAQ on New Format of GSTR 3B

- Accounting Entries and ITC Documentations

- TRAN 1/TRAN 2 Guidelines

- CGST Act, Rules and Circulars on ITC

Read more at: https://www.edukating.com/course-gst-itc-book-98.php https://www.caclubindia.com/books/gst-itc-draft-replies-internal-controls-3772.asp

Author CA Vishal G Poddar, Adv. Nitin Sharma, CA Pooja Garg , Special Thanks to CA Arun Chhajer

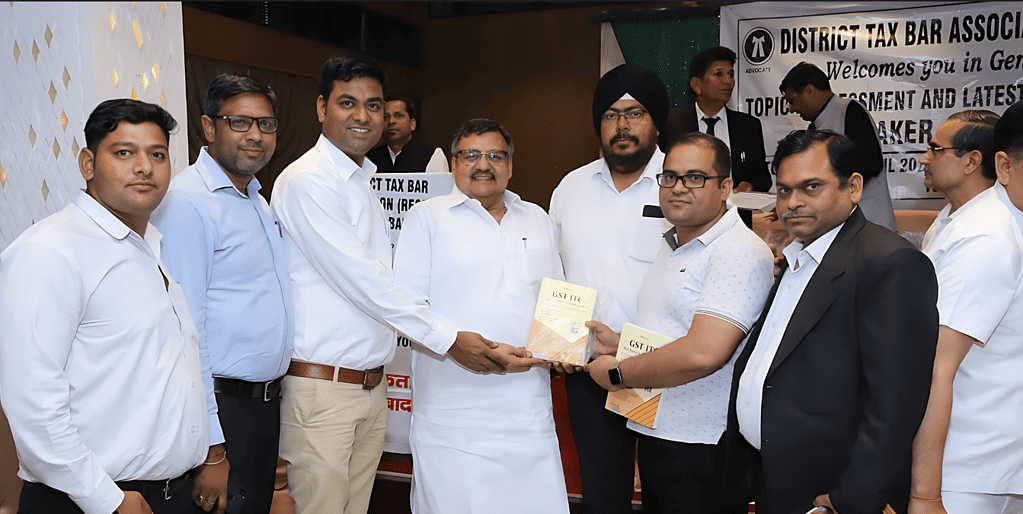

Book Presented to Sh. Surinder Dutt Sharma Advocate (Co-Chairman) Bar Council Punjab & Haryana

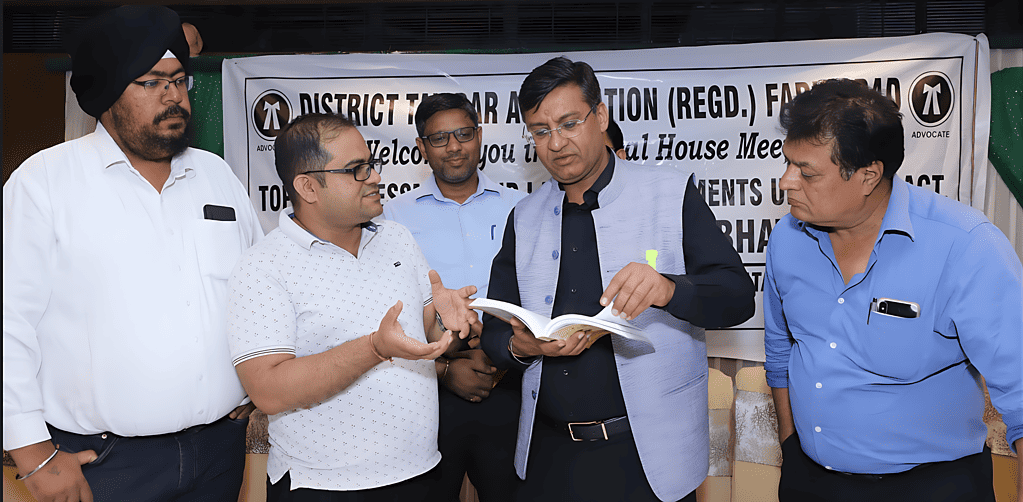

Book Presented to Adv. Vineet Bhatia – Founding Partner Bhatia & Bhatia, Law Firm

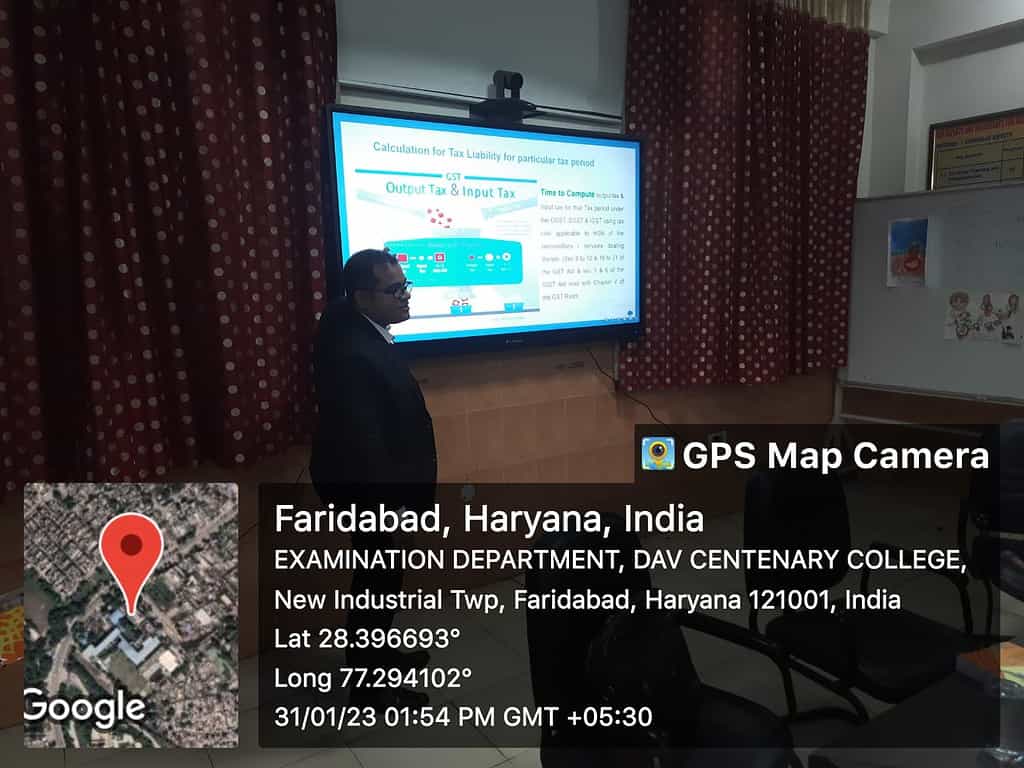

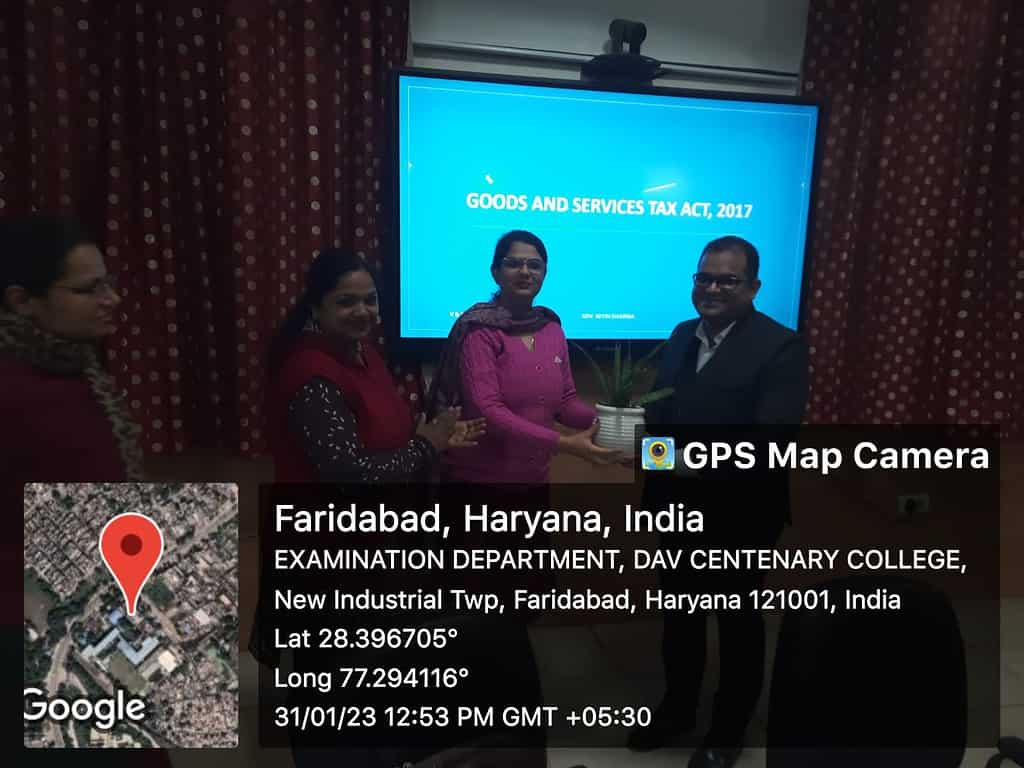

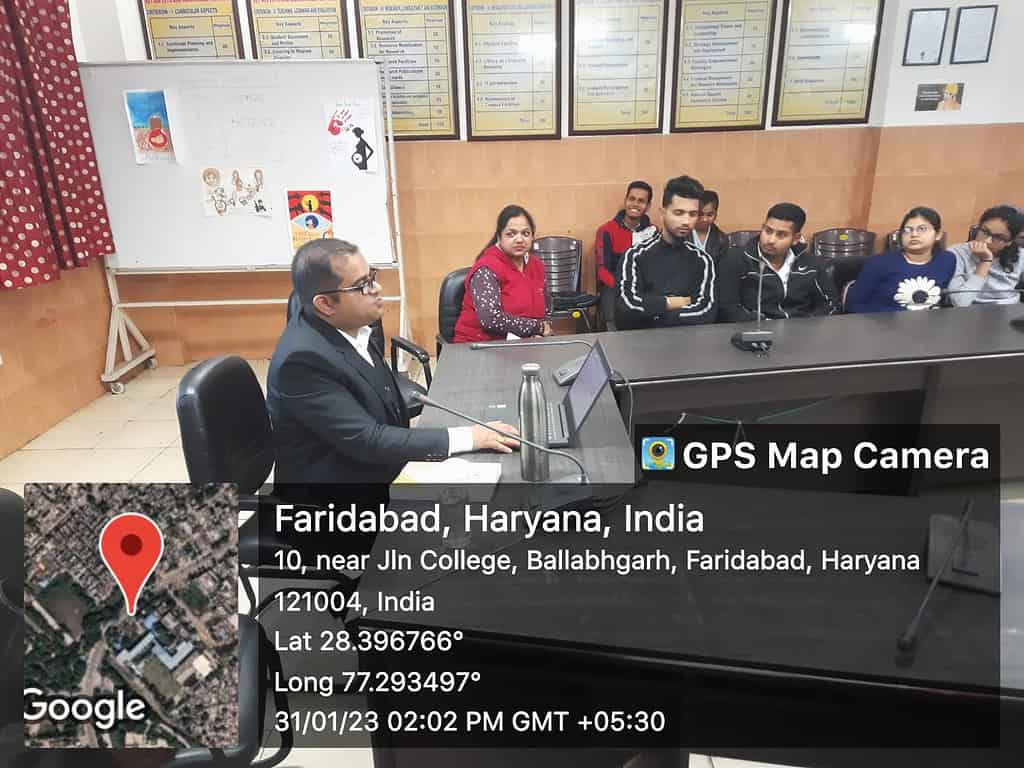

GST Extension Lecture at D.A.V. Centenary College, Faridabad

Second Book on GST – ” How to Handle GST Audit with Real Life Case Studies”

In 2017, India introduced the Goods and Services Tax (GST), a significant tax reform that reshaped the nation’s tax landscape. This transformation brought both opportunities and challenges for businesses of all sizes.

This Book offers valuable insights, audit selection, Audit procedures, real-life case studies, and practical strategies to face GST audits confidently.

- The book sheds light on the essence of GST audits, the entities subject to scrutiny, and key objectives.

- It unlocks the mystery of Audit Selection and audit procedures, where the Audit team is lacking, The Aftermath of Audit

- It provides a detailed, step-by-step guide to navigate the audit journey and includes real-life case studies for effective audit handling.

Read more at: https://www.bharatlaws.com/book_detail.php?book_id=1065

https://www.edukating.com/course-gst-audit-book-124.php

https://shopscan.in/product/https-how-to-handle-gst-audit-with-real-life-case-studies-pre-order-now/

Author CA Arun Chhajer, MD. Samar, Adv. Nitin Sharma,

Special Thanks to MD. Samar