GST Blogs

The purpose of this blog is to share knowledge on Indirect Tax – Goods and Services Tax and relevant blogs for Education …

author’s desk

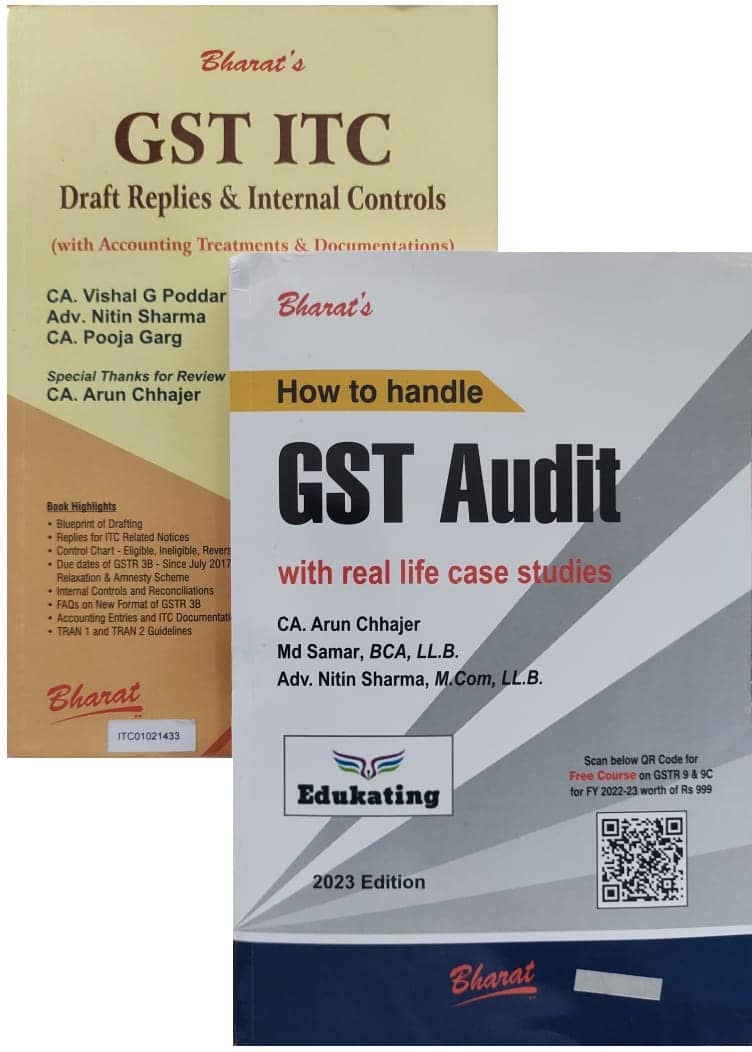

Authored two books on GST : 1. GST ITC – Draft Replies & Internal Controls. 2. How to Handle GST Audit with real-life Case Studies.

Day at DAV College

GST Extension Lecture to the Students of MBA and BBA final year at DAV College, Faridabad by Adv Nitin Sharma …..

Testimonials

Motivational Words from clients

Nitin Tewatia

a.K. & Co.

The Team is very cooperative and they know how to regard people and work management abilities are outstanding

Surya Garg

Hotel Sun City

Very well work happy to work with them ❤️

I. Sharma

Civil Cont.

A fabulous stop of all solutions regarding taxation.

Arvinder Singh Panesar

ANAND, GUJARAT

Good experience to resolve the problem

Mohd. Samar

GST Hub, Ara

They have a very open and collaborative culture that is always led by client obsession.

CA Shivani Bhardwaj

DELHI NCR

Best Law Firm.. Highly qualified and experienced Professionals.. Very helpful and dependable service providers.. Highly Recommend their services.

Sachin Vashishth

FARIDABAD

Had a great experience with such a professional staff. Best services for all Taxation/GST matters..

Asha Ghildiyal

DELHI, NCR

Really appreciable work with a good management system.